Corporate News

The Trend of Hibor, Market Liquidity and HSI

05 Apr 2023

In recent times, multiple banks in Europe and the United States, such as Silicon Valley Bank and Credit Suisse, have experienced financial failures. These events have resulted in depositors losing their confidence in the banking industry, leading them to withdraw or transfer their funds. Consequently, there are rumors circulating in the market that suggest "hundreds of billions of dollars in savings and funds from Europe and the United States are flooding into Hong Kong." However, there is currently no official data available to substantiate these claims. The Hong Kong government has only disclosed bank deposit data up to the end of February.

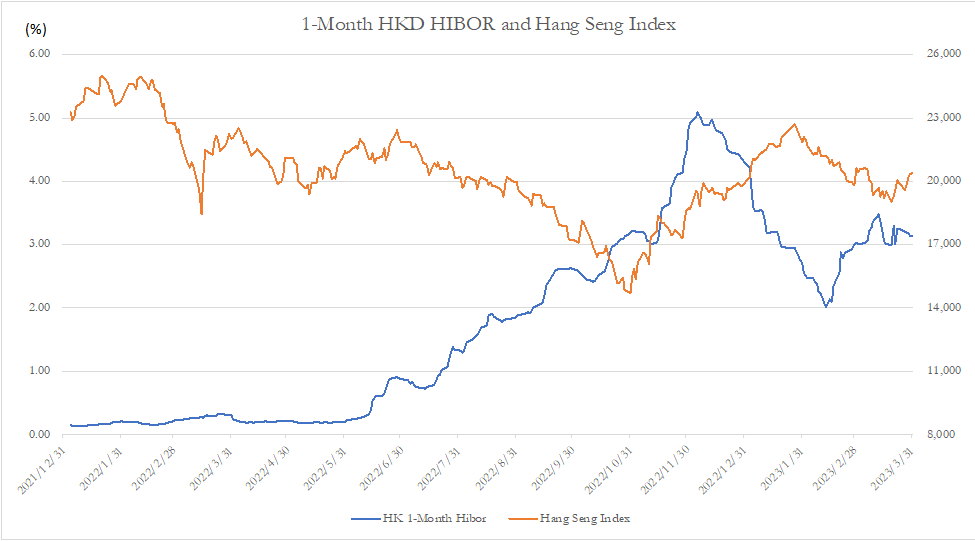

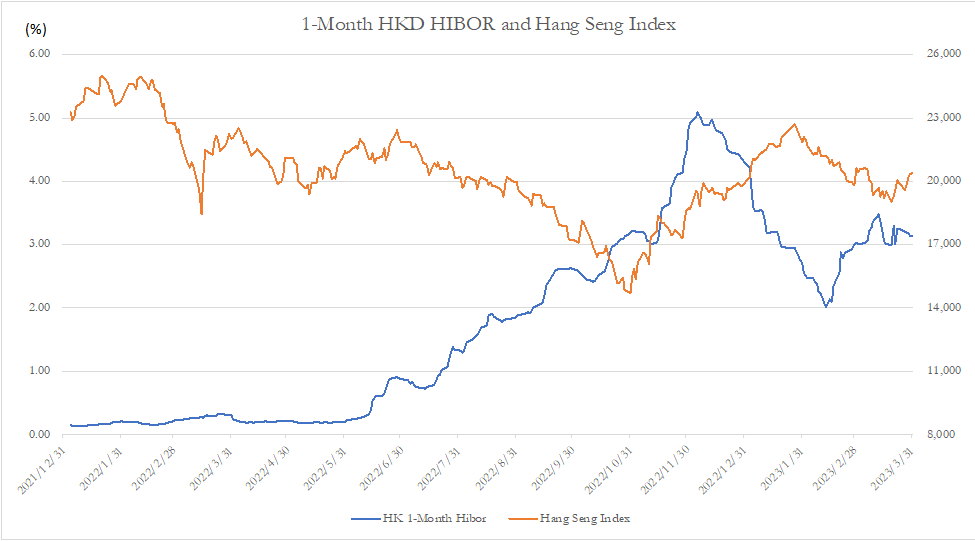

If a significant amount of capital were to enter Hong Kong, it is theoretically expected that the interbank liquidity in Hong Kong would become more abundant, and the Hong Kong Interbank Offered Rate (Hibor) would indicate a downward trend. Such a reduction in financing costs would likely benefit the stock market. However, despite such an influx of capital, the recent Hibor has not exhibited a definitive downward trend, and on March 20, it even showed a slight rebound. Furthermore, during the same period, the Hang Seng Index only remained hovering around 20,000 points, which indicates a lack of upward momentum.

Based on the available data, it appears that the reported massive inflow of capital into Hong Kong is an overinterpretation of the events that have taken place in European and American banks and has not yet transpired. While it may be premature to assess the trend of the Hong Kong stock market in the upcoming months based solely on existing market fund data, important indices such as the Hibor can still provide valuable insights that enable us to make informed deductions.

Read More